Have you just checked your credit score and were left disheartened? Stop panicking. Whether you are just starting to build your credit score or rebuilding it after a setback, making the score better can sometimes feel like a tiresome task, but in reality, anyone can actually take the steps to keep things going in the right direction.

It definitely takes some time, but your credit health journey is worth all your efforts. There will be some wins to celebrate along the way.

Now, let us take a look at what a credit score actually is, why it matters so much, what can be done to make it better and how long it will take to see a positive change.

What is a Credit Score? Why Does it Matter?

A credit score is a number calculated by credit reference agencies based on your financial history. Lenders will be looking for your credit score while you are applying for loans, car finance, mortgages or any other credit products to decide whether you qualify and the level of interest to charge if you qualify for the loan.

There are several actions that you can choose to improve your credit score, like getting a credit card for bad credit, so that you can start demonstrating responsible borrowing behaviour. But what are the other options you have, and how long will they take to have an effect on your credit score?

How Long Does it Take to Improve Your Credit Score?

The honest answer for this will be. It Depends.

Some changes may impact your credit score directly in just a few weeks, while some may take several months or longer. All of it depends on what your credit report is and also the steps you are taking to improve your credit score.

It can take even longer to build up your credit score if you have no credit history. In the same way, if you have been declared bankrupt, this stays on your credit score for six years, though the impact on your credit score will reduce over time.

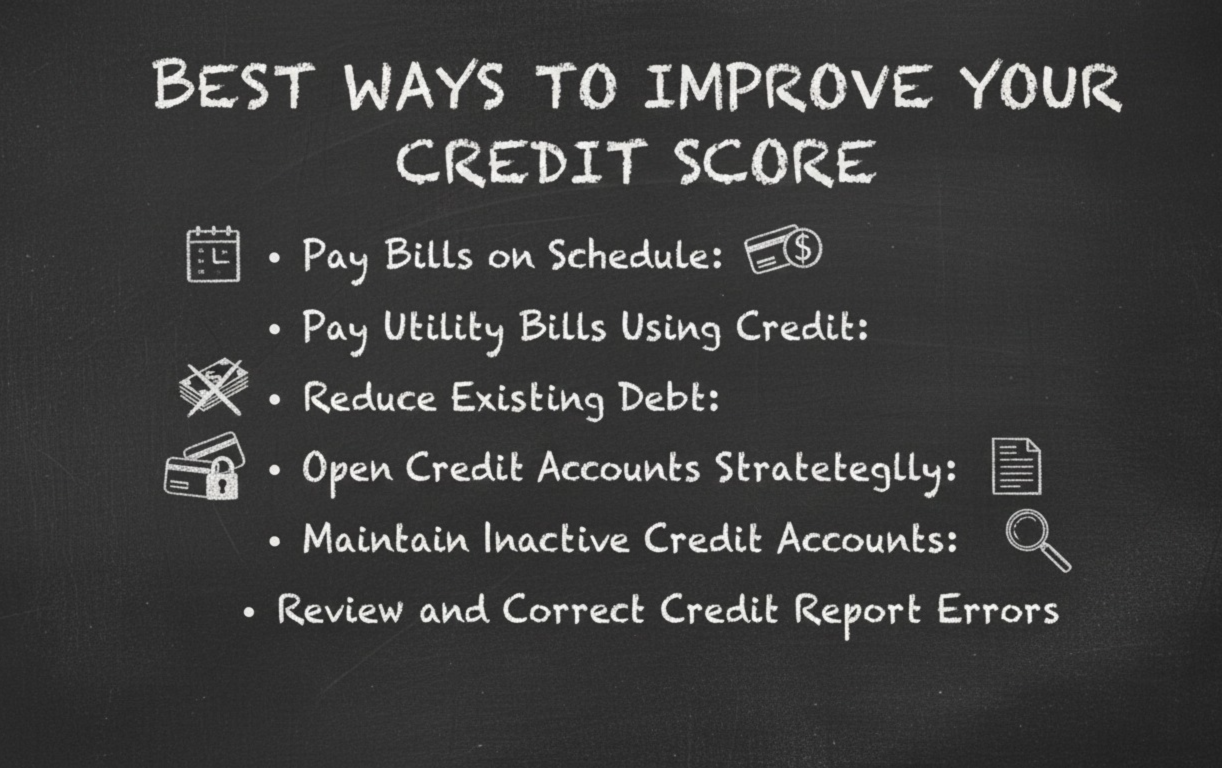

Best Ways to Improve Your Credit Score

There are several ways to improve your credit score, and with a little effort, you can start to see your score climb.

1. Pay Bills on Schedule

Once the lender accepts your verification request, it will be sent for a credit score calculation. The lender’s main concern is your bill payment history. This will clear your creditworthiness, and the lender will be assured of your credibility as a borrower. Using your past history, lenders will predict your loan repayment in the future. This is the primary reason that you must always pay your bills within the given time period. If you pay your bills late, it will affect your chances of getting loans from reputable financial institutions in the future. You can use reminders to ensure that you make the payments without delay. The current liabilities must be cleared as soon as possible.

2. Pay Utility Bills Using Credit

If you’ve been regularly and promptly settling your utility bills, then it would be a wise decision to check your credit score. Make a fixed order to your bank/banking representative for a consistent monthly deduction.

3. Reduce Existing Debt

Another crucial point about credit scores is the credit utilisation ratio. This is a key element in the accurate calculation of your credit score. You take the total of your credit card balances and divide that figure by the total credit limit. To explain, if your credit balance is Rs . 4000, and the credit limit is Rs . 10000, the utilization ratio then is 40%. Credit unions are more inclined to a credit utilisation ratio of around 30% or more. A low credit utilisation ratio indicates that you barely use your credit card and prefer cash transactions.

4. Open Credit Accounts Strategically

Try to avoid taking up credit accounts if you don’t need them immediately. Don’t stress your account too much; instead, keep a good balance of liabilities and assets. Your credit score can be negatively affected by too much credit, and it can also entice you to be rejected by many sources.

5. Maintain Inactive Credit Accounts

Don’t close your unused credit cards; keep them protected. When you have more unused credit cards, your credit utilisation ratio gets impacted. Having fewer credit accounts can also result in lower credit scores.

6. Review and Correct Credit Report Errors

Make sure you have checked your credit reports before figuring out the discrepancies at the earliest. Verify your reports with all major credit bureaus; they will guide you to the best one. Any incorrect information can mess up your credit score even more. If errors are not corrected quickly, they will affect your credit score.

Boost Your Credit Score with Professional Support

Boosting your credit score with the help of professionals can be a game-changer for your financial journey. TRK Finance delivers expert advice and customised solutions that can enable you to enhance your credit score. A group of experts from the company offers you credit counselling, debt management plans, and personalised advice that takes into account your individual financial situation.

- TRK Finance provides personal credit counselling sessions to understand the reasons behind low credit scores and create a detailed plan for gradual enhancement.

- Through their debt management plans, you get the chance to bring together and handle your debts in a way that lowers your financial stress and gradually increases your credit score.

- They will develop tailored strategies and also give you continuous support so that you can be on the right track and make wise decisions that will help you improve your credit profile.

- Experts at TRK Finance constantly update their knowledge of credit reporting and financial regulations; thus, they can offer you dependable and current advice.

Conclusion

A credit score is what determines if you can get a personal loan or not. Moreover, it offers revealing information about the individual’s ability to pay back on time or make payment defaults in the future.

Besides that, it is an indication of how consistently the loan repayments would be made if the loan application is approved. Better scores signify an increased ability to get a next loan and have credit at lower and more favorable interest rates. Consequently, you will be able to save more money.

In order to upgrade your credit score, first confirm what your current credit scores are. By analysing your credit scores, you will get an idea of the elements that most significantly influence your credit score. Also, your creditors and financial institutions will point out the areas that require your attention.

TRK Finance is a source of expertise that you can take advantage of to manage your money efficiently, improve your credit score, and have a reasonable level of confidence while you are accomplishing your financial goals.